57. Uncertainty Traps#

57.1. Overview#

In this lecture we study a simplified version of an uncertainty traps model of Fajgelbaum, Schaal and Taschereau-Dumouchel [FSTD15].

The model features self-reinforcing uncertainty that has big impacts on economic activity.

In the model,

Fundamentals vary stochastically and are not fully observable.

At any moment there are both active and inactive entrepreneurs; only active entrepreneurs produce.

Agents – active and inactive entrepreuneurs – have beliefs about the fundamentals expressed as probability distributions.

Greater uncertainty means greater dispersions of these distributions.

Entrepreneurs are risk averse and hence less inclined to be active when uncertainty is high.

The output of active entrepreneurs is observable, supplying a noisy signal that helps everyone inside the model infer fundamentals.

Entrepreneurs update their beliefs about fundamentals using Bayes’ Law, implemented via Kalman filtering.

Uncertainty traps emerge because:

High uncertainty discourages entrepreneurs from becoming active.

A low level of participation – i.e., a smaller number of active entrepreneurs – diminishes the flow of information about fundamentals.

Less information translates to higher uncertainty, further discouraging entrepreneurs from choosing to be active, and so on.

Uncertainty traps stem from a positive externality: high aggregate economic activity levels generates valuable information.

57.2. The Model#

The original model described in [FSTD15] has many interesting moving parts.

Here we examine a simplified version that nonetheless captures many of the key ideas.

57.2.1. Fundamentals#

The evolution of the fundamental process \(\{\theta_t\}\) is given by

where

\(\sigma_\theta > 0\) and \(0 < \rho < 1\)

\(\{w_t\}\) is IID and standard normal

The random variable \(\theta_t\) is not observable at any time.

57.2.2. Output#

There is a total \(\bar M\) of risk averse entrepreneurs.

Output of the \(m\)-th entrepreneur, conditional on being active in the market at time \(t\), is equal to

Here the time subscript has been dropped to simplify notation.

The inverse of the shock variance, \(\gamma_x\), is called the shock’s precision.

The higher is the precision, the more informative \(x_m\) is about the fundamental.

Output shocks are independent across time and firms.

57.2.3. Information and Beliefs#

All entrepreneurs start with identical beliefs about \(\theta_0\).

Signals are publicly observable and hence all agents have identical beliefs always.

Dropping time subscripts, beliefs for current \(\theta\) are represented by the normal distribution \(N(\mu, \gamma^{-1})\).

Here \(\gamma\) is the precision of beliefs; its inverse is the degree of uncertainty.

These parameters are updated by Kalman filtering.

Let

\(\mathbb M \subset \{1, \ldots, \bar M\}\) denote the set of currently active firms

\(M := |\mathbb M|\) denote the number of currently active firms

\(X\) be the average output \(\frac{1}{M} \sum_{m \in \mathbb M} x_m\) of the active firms

With this notation and primes for next period values, we can write the updating of the mean and precision via

These are standard Kalman filtering results applied to the current setting.

Exercise 1 provides more details on how (57.2) and (57.3) are derived, and then asks you to fill in remaining steps.

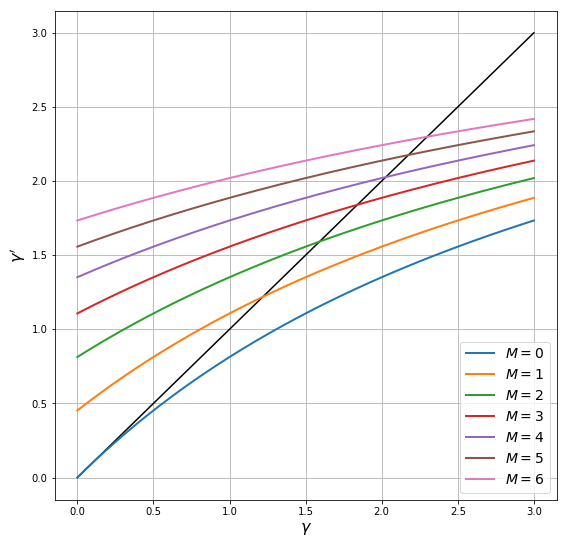

The next figure plots the law of motion for the precision in (57.3) as a 45 degree diagram, with one curve for each \(M \in \{0, \ldots, 6\}\).

The other parameter values are \(\rho = 0.99, \gamma_x = 0.5, \sigma_\theta =0.5\)

Points where the curves hit the 45 degree lines are long run steady states for precision for different values of \(M\).

Thus, if one of these values for \(M\) remains fixed, a corresponding steady state is the equilibrium level of precision

high values of \(M\) correspond to greater information about the fundamental, and hence more precision in steady state

low values of \(M\) correspond to less information and more uncertainty in steady state

In practice, as we’ll see, the number of active firms fluctuates stochastically.

57.2.4. Participation#

Omitting time subscripts once more, entrepreneurs enter the market in the current period if

Here

the mathematical expectation of \(x_m\) is based on (57.1) and beliefs \(N(\mu, \gamma^{-1})\) for \(\theta\)

\(F_m\) is a stochastic but previsible fixed cost, independent across time and firms

\(c\) is a constant reflecting opportunity costs

The statement that \(F_m\) is previsible means that it is realized at the start of the period and treated as a constant in (57.4).

The utility function has the constant absolute risk aversion form

where \(a\) is a positive parameter.

Combining (57.4) and (57.5), entrepreneur \(m\) participates in the market (or is said to be active) when

Using standard formulas for expectations of lognormal random variables, this is equivalent to the condition

57.3. Implementation#

We want to simulate this economy.

We’ll want a named tuple generator of the kind that we’ve seen before.

And we need methods to update \(\theta\), \(\mu\) and \(\gamma\), as well as to determine the number of active firms and their outputs.

The updating methods follow the laws of motion for \(\theta\), \(\mu\) and \(\gamma\) given above.

The method to evaluate the number of active firms generates \(F_1, \ldots, F_{\bar M}\) and tests condition (57.6) for each firm.

using Pkg; pkgs = ["DataFrames", "LaTeXStrings", "Plots"]; all(haskey.(Ref(Pkg.project().dependencies), pkgs)) || Pkg.add(pkgs)

using LinearAlgebra, Statistics

using DataFrames, LaTeXStrings, Plots

function # standard dev. of shock

UncertaintyTrapEcon(; a = 1.5, # risk aversion

gamma_x = 0.5, # production shock precision

rho = 0.99, # correlation coefficient for theta

sigma_theta = 0.5, # standard dev. of theta shock

num_firms = 100, # number of firms

sigma_F = 1.5, # standard dev. of fixed costs

c = -420.0, # external opportunity cost

mu_init = 0.0, # initial value for mu

gamma_init = 4.0, # initial value for gamma

theta_init = 0.0, # initial value for theta

sigma_x = sqrt(a / gamma_x)) # standard dev. of shock

(; a, gamma_x, rho, sigma_theta, num_firms, sigma_F, c, mu_init, gamma_init,

theta_init, sigma_x)

end

UncertaintyTrapEcon (generic function with 1 method)

In the results below we use this code to simulate time series for the major variables.

57.4. Results#

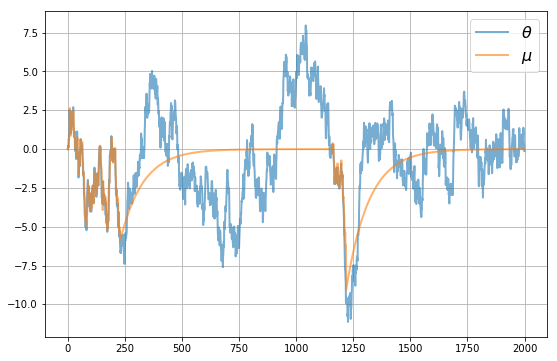

Let’s look first at the dynamics of \(\mu\), which the agents use to track \(\theta\)

We see that \(\mu\) tracks \(\theta\) well when there are sufficient firms in the market.

However, there are times when \(\mu\) tracks \(\theta\) poorly due to insufficient information.

These are episodes where the uncertainty traps take hold.

During these episodes

precision is low and uncertainty is high

few firms are in the market

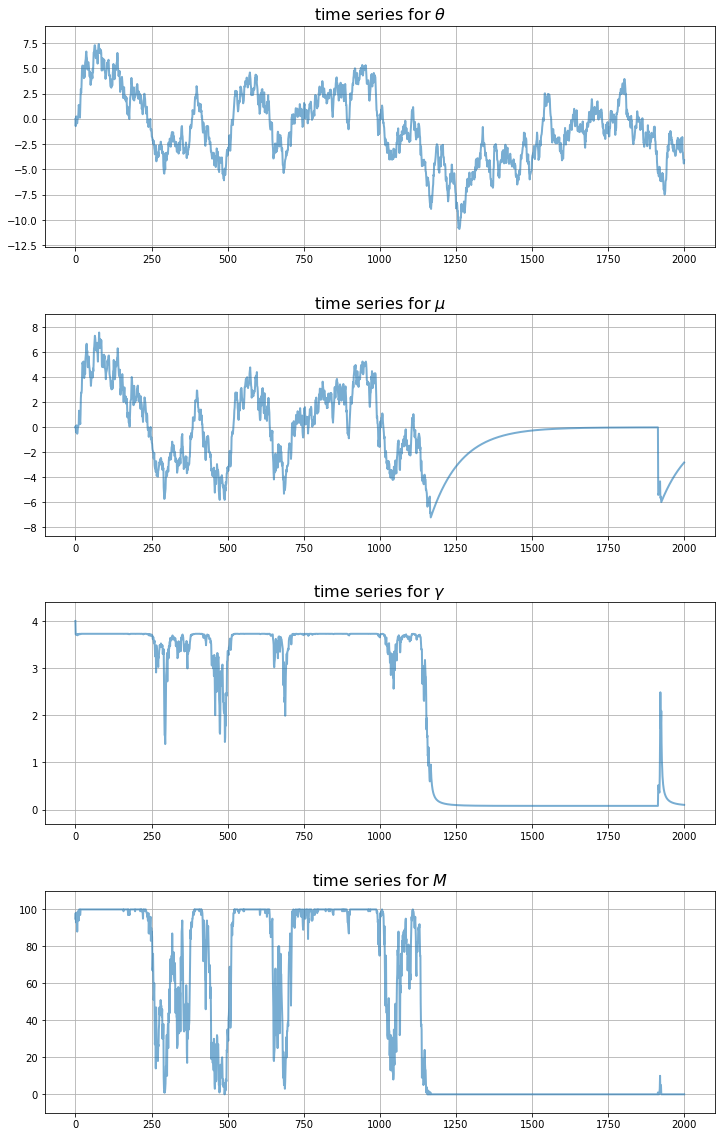

To get a clearer idea of the dynamics, let’s look at all the main time series at once, for a given set of shocks

Notice how the traps only take hold after a sequence of bad draws for the fundamental.

Thus, the model gives us a propagation mechanism that maps bad random draws into long downturns in economic activity.

57.5. Exercises#

57.5.1. Exercise 1#

Fill in the details behind (57.2) and (57.3) based on the following standard result (see, e.g., p. 24 of [YS05]).

Fact Let \(\mathbf x = (x_1, \ldots, x_M)\) be a vector of IID draws from common distribution \(N(\theta, 1/\gamma_x)\) and let \(\bar x\) be the sample mean. If \(\gamma_x\) is known and the prior for \(\theta\) is \(N(\mu, 1/\gamma)\), then the posterior distribution of \(\theta\) given \(\mathbf x\) is

where

57.5.2. Exercise 2#

Modulo randomness, replicate the simulation figures shown above

Use the parameter values listed as defaults in the function UncertaintyTrapEcon.

57.6. Solutions#

57.6.1. Exercise 1#

This exercise asked you to validate the laws of motion for \(\gamma\) and \(\mu\) given in the lecture, based on the stated result about Bayesian updating in a scalar Gaussian setting.

The stated result tells us that after observing average output \(X\) of the \(M\) firms, our posterior beliefs will be

where

If we take a random variable \(\theta\) with this distribution and then evaluate the distribution of \(\rho \theta + \sigma_\theta w\) where \(w\) is independent and standard normal, we get the expressions for \(\mu'\) and \(\gamma'\) given in the lecture.

57.7. Exercise 2#

First let’s replicate the plot that illustrates the law of motion for precision, which is

Here \(M\) is the number of active firms. The next figure plots \(\gamma_{t+1}\) against \(\gamma_t\) on a 45 degree diagram for different values of \(M\)

econ = UncertaintyTrapEcon()

(; rho, sigma_theta, gamma_x) = econ # simplify names

# grid for gamma and gamma_{t+1}

gamma = range(1e-10, 3, length = 200)

M_range = 0:6

gammap = 1 ./ (rho^2 ./ (gamma .+ gamma_x .* M_range') .+ sigma_theta^2)

labels = ["0" "1" "2" "3" "4" "5" "6"]

plot(gamma, gamma, lw = 2, label = "45 Degree")

plot!(gamma, gammap, lw = 2, label = labels)

plot!(xlabel = L"\gamma", ylabel = L"\gamma^\prime", legend_title = L"M",

legend = :bottomright)

The points where the curves hit the 45 degree lines are the long run steady states corresponding to each \(M\), if that value of \(M\) was to remain fixed. As the number of firms falls, so does the long run steady state of precision.

Next let’s generate time series for beliefs and the aggregates – that is, the number of active firms and average output

function simulate(uc, capT = 2_000)

# unpack parameters

(; a, gamma_x, rho, sigma_theta, num_firms, sigma_F, c, mu_init, gamma_init, theta_init, sigma_x) = uc

# draw standard normal shocks

w_shocks = randn(capT)

# aggregate functions

# auxiliary function psi

function psi(gamma, mu, F)

temp1 = -a * (mu - F)

temp2 = 0.5 * a^2 / (gamma + gamma_x)

return (1 - exp(temp1 + temp2)) / a - c

end

# compute X, M

function gen_aggregates(gamma, mu, theta)

F_vals = sigma_F * randn(num_firms)

M = sum(psi.(Ref(gamma), Ref(mu), F_vals) .> 0) # counts number of active firms

if any(psi(gamma, mu, f) > 0 for f in F_vals) # there is an active firm

x_vals = theta .+ sigma_x * randn(M)

X = mean(x_vals)

else

X = 0.0

end

return (; X, M)

end

# initialize dataframe

X_init, M_init = gen_aggregates(gamma_init, mu_init, theta_init)

df = DataFrame(gamma = gamma_init, mu = mu_init, theta = theta_init,

X = X_init, M = M_init)

# update dataframe

for t in 2:capT

# unpack old variables

theta_old, gamma_old, mu_old, X_old, M_old = (df.theta[end],

df.gamma[end], df.mu[end],

df.X[end], df.M[end])

# define new beliefs

theta = rho * theta_old + sigma_theta * w_shocks[t - 1]

mu = (rho * (gamma_old * mu_old + M_old * gamma_x * X_old)) /

(gamma_old + M_old * gamma_x)

gamma = 1 / (rho^2 / (gamma_old + M_old * gamma_x) + sigma_theta^2)

# compute new aggregates

X, M = gen_aggregates(gamma, mu, theta)

push!(df, (; gamma, mu, theta, X, M))

end

# return

return df

end

simulate (generic function with 2 methods)

First let’s see how well \(\mu\) tracks \(\theta\) in these simulations

df = simulate(econ)

plot(eachindex(df.mu), df.mu, lw = 2, label = L"\mu")

plot!(eachindex(df.theta), df.theta, lw = 2, label = L"\theta")

plot!(xlabel = L"x", ylabel = L"y", legend_title = "Variable",

legend = :bottomright)

Now let’s plot the whole thing together

len = eachindex(df.theta)

yvals = [df.theta, df.mu, df.gamma, df.M]

vars = [L"\theta", L"\mu", L"\gamma", L"M"]

plt = plot(layout = (4, 1), size = (600, 600))

for i in 1:4

plot!(plt[i], len, yvals[i], xlabel = L"t", ylabel = vars[i], label = "")

end

plot(plt)